Walter E. Williams Polishes the Turd on Tariffs

Canal boats (foreground) and blue-water sailing ships crowd the waterfront near South Street in lower Manhattan in this 1858 view by Franklin White of Lancaster, New Hampshire. In that year, customs duties collected at the Port of New York alone provided nearly half of all federal revenue. When foreign trade rebounded the next year after the Panic of 1857, customs duties collected at the Port of New York accounted for almost two-thirds of federal revenue. From Johnson and Lightfoot, Maritime New York in Nineteenth-Century Photographs.

The other day, George Mason University economist Walter E. Williams published an opinion piece in the Washington Examiner, asking in the title, “was the Civil War about tariff revenue?” Like many of his columns that deal with that conflict, he tosses in all sorts of obfuscatory boilerplate about Lincoln not liking black folks much, how the Emancipation Proclamation didn’t actually free all the slaves, and how Lincoln, more than a decade before the war began, had made some general comments about the inherent right of revolution. Williams doesn’t get around to discussing, you know, tariff revenue, until the very end, more than nine-tenths of the way through the 657-word piece, when he says (my emphasis),

![]()

![]()

I want to focus on that line about Southern ports paying 75% of import tariffs, because it’s the core of his entire argument. He’s playing an classic trick, throwing out some impressive factoid, and then asking a rhetorical question based on it, that seemingly has an obvious answer. The problem is that, in this case, his devastating “fact” — “Southern ports paid 75 percent of tariffs in 1859” — isn’t even close to being true.

The first red flag here is that annual tariff data was not collected and reported by the Treasury Department based on calendar years, but by fiscal years that ran from July 1 to June 30. So when Williams says “in 1859,” it’s unclear whether he’s talking about the reporting year that ended in 1859 (FY 1859), or the reporting year that began in 1859 (FY 1860). That’s a revealing slip-up, but it’s also one that doesn’t matter, because the claim is demonstrably untrue for both fiscal years, and so for the calendar year of 1859, as well.

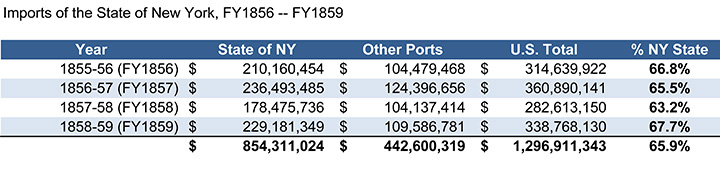

Data for imports and tariffs collected for the year just prior to secession (July 1, 1859 to June 30, 1860, inclusive) is provided in the Annual Report of the Chamber of Commerce of the State of New York, for the Year 1860-61 (New York: John Amerman, 1861), 57-66. I’ve uploaded a PDF copy of the relevant pages here. The first two pages include imports that were not tariffed; in case anyone was wondering, manures and guano were duty-free.

In summary, during that year the Port of New York took in $233.7M, of which $203.4M were subject to tariffs ranging from 4 to 30%. During that same period, all other U.S. ports combined received $128.5M in imports, of which $76.5M was subject to tariff. So the Port of New York, by itself, handled almost two-thirds (64.5%) of the value of all U.S. imports, and almost three-quarters (72.7%) of the value of all tariffed imports:

![]()

![]()

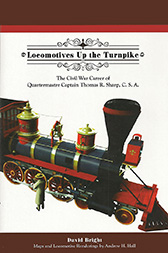

What about earlier years? The previous year’s report from the New York State Chamber of Commerce carries a table (p. 2) that breaks out imports clearing customs in all of New York State for the previous four fiscal years:

![]()

![]()

A glance at these numbers makes clear that in spite of some year-to-year variation in import volumes — there was an economic crash in 1857 — the share of imports coming into New York remained remarkably stable, at around two-thirds of all imports coming into the United States. (And this isn’t even including other major ports like Boston and Philadelphia.)

What about customs revenues, specifically? The Chamber of Commerce from 1860 reports — on the very first page — customs revenue for Port of New York for 1859 at $38,834,212, or about 63.5% of the $61.1M in federal revenue that year. The Port of New York, alone, accounted for nearly two-thirds of U.S. Government revenue in 1859. Williams’ assertion that “Southern ports paid 75 percent of tariffs in 1859” isn’t a case of “lying with statistics,” because the statistics don’t actually say anything remotely like that. It’s a case of lying, period.

So where does this made-up-from-whole-cloth assertion come from? Williams’ column has been splattered all over the Internet in the last few days, no doubt because it seemingly affirms modern cultural/political fears about big gubmint avarice. But the idea that Lincoln refused to accede to the Southern states’ secession because they represented the large majority of federal government’s revenue has been percolating around for a while. Thomas DiLorenzo — who Williams cites in the first graf of the piece — made a related and equally implausible claim in his 2002 book, (The Real Lincoln, pp. 125-26) that “in 1860 the Southern states were paying in excess of 80 percent of all tariffs. . . .” People who’d looked at the actual numbers, including friend-of-this-blog Jim Epperson, called him out on that claim, which DiLorenzo eventually (and quietly) revised in his most recent edition to a somewhat more vague “were paying the Lion’s share of all tariffs.” DiLorenzo, not surprisingly, provides no citation to back this claim. But it’s and old turd of a notion that’s been around a long time, that Walter Williams has pulled out, polished off, and given new life on the interwebs.

(DiLorenzo’s wording is a little different, saying that the “Southern states” were paying tariffs. It’s a strange construction, given that the states weren’t paying tariffs at all, and the tariffs were paid by the merchants doing the importing — who were generally Northerners. Even if DiLorenzo were to argue that it was the end-of-the-line consumer who “paid” the tarfiff through higher costs for goods, it’s a claim that defies credulity, as it would require the eleven states that ultimately seceded, with less than a third of the nation’s population, to be consuming more than four-fifths of all the tariffed good brought into the entire county. It’s a ludicrous notion, which is probably why DiLorenzo doesn’t even pretend to offer a source for it.)

Williams and DiLorenzo have both made a good living writing books and essays and giving speeches that are full of half-truths, selective quotes, and (as in this case) outright fabrications, all directed to a narrow but extremely-loyal audience of people who are primed to believe anything bad about the federal government (then or now). Both men hold endowed academic appointments, which means they cost their respective institutions relatively little, and in return are free of heavy teaching loads and the imperative of generating peer-reviewed publications that stalk most faculty members through much of their careers. Fair enough, but Williams’ assertion that “Southern ports paid 75 percent of tariffs” is surely in a league by itself. On its face it strains credulity; one needs only a basic understanding of American history to know how overwhelmingly the Northern Atlantic states and New England dominated this country’s maritime trade through the end of the 19th century. True Southrons™ often cite the heavy involvement of Northern shipping interests in the transatlantic slave trade, but that’s a selective and self-serving focus; that same region overwhelmingly dominated every other aspect of American maritime enterprise, from shipbuilding to whaling to the China trade to the nascent practice of marine engineering.

Williams surely knows this, and knows his assertion about the share of import tariffs paid through Southern ports is preposterous. If he doesn’t know it, he’s unworthy of his credentials, and if he does and asserts it anyway because that’s what his audience wants to hear, then he’s a charlatan on the order of someone like David Barton. I really can’t imagine what’s worse — the idea that he doesn’t actually know he’s wrong, or the idea that he doesn’t give a damn.

____________

UPDATE, February 25: In the comments, Craig Swain points out that he covered this same ground two years ago, over at Robert Moore’s place. I owe Craig an apology, because I not only read that post of his at the time, I also commented on it. I’d completely forgotten about that, at least consciously. Craig does a particularly good job of showing how those same tariff laws, which supposedly were so beneficial to Northern industries, also protected Southerners’ production of things like cotton, tobacco and sugar from competition from overseas.

Given the way spurious claims about tariffs are made over and over again by folks like Williams, naturally they’ve been exposed by others before. But it’s hard to use evidence to counter a belief that’s not based on evidence to begin with.

____________

Nice done Andy. It’s good to see some actual figures refute the claims of William and so many others.

Thanks. Williams trades in a misrepresented facts and out-of-context quotes. This one goes beyond that, being an outright fabrication.

Agreed.

Very articulate and balanced as usual.

To be fair with Walter E. Williams it’s not the author who chooses the title of his published articles but the editor-in-chief. Actually Williams makes it clear his column is more about Lincoln than the causes of the war: “this column is…about a man deified by many”, his column can be foun on other news websites like JewishWorldReview where it’s more accurately titled “Abraham Lincoln”.

I don’t think he lied on purpose. As said by the adage “some things are hold to be true because they’ve been repeated over and over again” his source on this issue is Thomas DiLorenzo so he’s in fact repeating another author’s statement which turned out to be false. His credentials shouldn’t be overshadowed by this unfortunate mistake. He wrote a book titled “Race and Economics: How much can be blamed on discrimination ?” which contains a very fine and overdue analysis about economic disparities among different groups of population.

Interestingly, his colleague and old friend Thomas Sowell, who also takes a conservative stance on many issues, wrote a column entitled “Trashing our history: Lincoln” which can be considered a counterpart to Williams’.

Hello Mr. Hall,

I would to come back again to the column, more precisely on its paragraphs regarding Lincoln’s stance on Blacks and slavery.

I don’t very much like the term “quoting out of context” because from my experience it’s a rhetorical play thrown at someone who quotes sentences very unpleasant for the opponent who needs to make his readers or listeners believe some famous guy or text doesn’t really say this or that. I prefer to talk about “misquotes”.

He first refers to an “1858 letter” where the then local politician affirmed: “I have declared a thousand times, and now repeat that, in my opinion neither the General Government, nor any other power outside of the slave states, can constitutionally or rightfully interfere with slaves or slavery where it already exists.”

However a full reading reveals Lincoln’s more complex position. In fact he affirms he will not interfere with slavery as it exists in slave states but he also states that preventing the expansion of the practice into the Territories will ultimately lead to its extinction: “I have declared a thousand times, and now repeat that, in my opinion, neither the General Government, nor any other power outside of the slave states, can constitutionally or rightfully interfere with slaves or slavery where it already exists. I believe that whenever the effort to spread slavery into the new teritories, by whatever means, and into the free states themselves, by Supreme court decisions, shall be fairly headed off, the institution will then be in course of ultimate extinction” (Letter to John L. Scripps, June 23 1858)

Williams talks about the July 17 1858 speech in Springfield, Illinois where Lincoln declared: “My declarations upon this subject of negro slavery may be misrepresented, but can not be misunderstood. I have said that I do not understand the Declaration (of Independence) to mean that all men were created equal in all respects”

Actually Lincoln was explicitly opposing Stephen Douglas’ position that Blacks were not included the Declaration of Independence when it stated that all men are created equal ! The full sentence is: “My declarations upon this subject of Negro slavery may be misrepresented, but cannot be misunderstood, I have said that I do not understand the Declaration to mean that all men are created equal in all respects. They are not our equal in color; but I suppose that it does mean that all men are equal in some respects; they are equal in their right to ‘life, liberty, and the pursuit of happiness.’ Certainly the Negro is not our equal in color–perhaps not in many other respects; still, in the right to put into his mouth the bread that his own hands have earned, he is the equal of every other man, white or black.”

Finally Williams refers to Lincoln saying during his fourth debate with Stephen Douglas : “I am not nor ever have been in favor of making voters or jurors of negroes, nor of qualifying them to hold office, nor to intermarry with white people; and I will say in addition to this that there is a physical difference between the white and black races which I believe will forever forbid the two races living together on terms of social and political equality. And inasmuch as they cannot so live, while they do remain together there must be the position of superior and inferior, and I as much as any other man am in favor of having the superior position assigned to the white race.” This is probably one of the best known quote of Lincoln and has been used endlessly for various political purposes. Either for people to declare him a “white supremacist” or for Southrons Trademark to declare him one of their own in segregating Blacks.

Both sides seems to have forgotten that Lincoln made a very similar remark in his first debate with a clarification throwing another light on his thought: “I have no purpose to introduce political and social equality between the white and the black races. There is a physical difference between the two, which, in my judgment, will probably forever forbid their living together upon the footing of perfect equality, and inasmuch as it becomes a necessity that there must be a difference, I, as well as Judge Douglas, am in favor of the race to which I belong having the superior position. I have never said anything to the contrary, but I hold that, notwithstanding all this, there is no reason in the world why the negro is not entitled to all the natural rights enumerated in the Declaration of Independence, the right to life, liberty, and the pursuit of happiness. I hold that he is as much entitled to these as the white man. I agree with Judge Douglas he is not my equal in many respects-certainly not in color, perhaps not in moral or intellectual endowment. But in the right to eat the bread, without the leave of anybody else, which his own hand earns, he is my equal and the equal of Judge Douglas, and the equal of every living man.”

Amusingly Lincoln’s opponent didn’t take him seriously, seeing his statement as rhetorical shenanigan which contradicted an earlier speech from him: “You know that in his Charleston speech, an extract from which he has read, he declared that the negro belongs to an inferior race; is physically inferior to the white man, and should always be kept in an inferior position. I will now read to you what he said at Chicago on that point. In concluding his speech at that place, he remarked: “My friends, I have detained you about as long as I desire to do, and I have only to say let us discard all this quibbling about this man and the other man-this race and that race, and the other race being inferior, and therefore they must be placed in an inferior position, discarding our standard that we have left us. Let us discard all these things, and unite as one people throughout this land until we shall once more stand up declaring that all men are created equal.” Thus you see, that when addressing the Chicago Abolitionists he declared that all distinctions of race must be discarded and blotted out, because the negro stood on an equal footing with the white man; that if one man said the Declaration of Independence did not mean a negro when it declared all men created equal, that another man would say that it did not mean another man; and hence we ought to discard all difference between the negro race and all other races, and declare them all created equal.”

After such a tedious reading I reassure you I will not delve deeper regarding the quotations. I will simply conclude that given the misleading and deceptive ways the earlier statements were quoted not much is to be hoped about the others. However I don’t think Dr. Williams deliberately falsified them. As he made it clear in his article he took them from an intermediary – and hostile – source without reading the originals.

Well it seems that some Northerners believed that the South provided 72% of exports.

“The South has furnished near three-fourths of the entire exports of the country. Last year she furnished seventy-two percent of the whole…we have a tariff that protects our manufacturers from thirty to fifty percent, and enables us to consume large quantities of Southern cotton, and to compete in our whole home market with the skilled labor of Europe . This operates to compel the South to pay an indirect bounty to our skilled labor, of millions annually.”

Daily Chicago Times, December 10, 1860

And

“There are no high cotton prices at high tariff rates and no low cotton prices at low tariff rates. Fluctuations due to super-abundant harvests, crop failures and depredations by the boll weevil are small compared to the enormous impact of high tariff rates. The rise of tariff rates from the lowest at 15% to the highest at 55% causes cotton prices to fall from 35 cents per pound to about 5 cents per pound.”

http://civilwarcause.com/relationship.html

This fall in the price of cotton to 5 cents/lbs, due to tariffs, caused great economic hardship in the South. This led to the Nullification Crisis, then eventually to lower tariffs. The tariffs had fallen to 15% by 1857. Tariff sanity. But then here comes the Republicans, planning to install high tariffs again, bringing back the tariff insanity.

What does that have to do with Williams’ completely false statement about tariffs?

Nothing at all.

Excellent post, smacking silliness with research.

Thanks.

FYI, the Examiner was created because the owner didn’t think the Washington Times was conservative enough. That’s hard to imagine I know…

This is very interesting. I have heard the argument Williams is making used often; I have never seen it refuted. When you add in Boston and Philadelphia, I would imagine the overwhelming amount of tariffed imports were coming into Northern ports.

Where would the idea that Southern ports were handling three-quarters of tariffed imports have originated, or, better yet, why would it have gained traction?

I will say that New York’s overwhelming dominance as evidenced by the above figures is surprising, given the importance not only of Boston and Philadelphia but also New Orleans and Charleston. I guess I had no idea that even in antebellum times New York was such an economic force.

Ask them to show you the numbers.

I bet they can’t even tell me where to find the numbers.

Jeff Davis said pretty much the same thing in his memoirs: “The effect of this was to impose the main burden of taxation upon the Southern people, who were consumers and not manufacturers, not only by the enhanced price of imports, but indirectly by the consequent depreciation in the value of exports, which were chiefly the products of Southern States.”

It almost certainly didn’t originate with him, but I would guess he had a large contribution towards giving it traction.

Then there’s the earlier Williams howler in his column ” The Civil War wasn’t about slavery” http://www.jewishworldreview.com/cols/williams120298.asp where he claimed,

>>The North favored protective tariffs for their manufacturing industry. The South, which exported agricultural products to and imported manufactured goods from Europe, favored free trade and was hurt by the tariffs. Plus, a northern-dominated Congress enacted laws similar to Britain’s Navigation Acts to protect northern shipping interests.

Shortly after Lincoln’s election, Congress passed the highly protectionist Morrill tariffs.

That’s when the South seceded, setting up a new government. Their constitution was nearly identical to the U.S. Constitution except that it outlawed protectionist tariffs, business handouts and mandated a two-thirds majority vote for all spending measures.<<

Madison, a Virginian and a plantation owner, clearly stated during the Nullification Crisis that the Constitutional powers given Congress to regulate commerce with foreign nations and to impose tariffs not only included the protection of domestic industry but was one of the essential reasons for the grant of these powers.

At no point, prior to the resignation of rebel state senators and congressmen as their states joined the rebellion, can the Congress be said to be northern-dominated especially in the sense that Williams clearly intends it. Republicans gained in the House in the 1858 elections (although not enough to elect their candidate as speaker) but the Democrats retained control of the Senate. Until very near the outbreak of the war, free state Democrats generally voted to support their southern comrades' demands and Sen.

The Morrill Tariff was no tariff of abominations although it did represent increases over the extremely low tariffs and high number of exemptions in the antebellum tariffs, especially the Tariff of 1857. But Williams just plain lies over the timing secession and the Morrill Tariff to find causation not found at the time. The Morrill Tariff certainly would have remained bottled up in the Senate after passing the House as had been its fate before the 1860 Election had not seven Southern states announced their secession in December and January 1861 and their senators and congressmen then resigned first. It was passed by Congress in March 1861 and signed by James Buchanan as one of his last acts as President. By the time the Morrill Tariff became law, the Star of the West had been fired upon, the provisional Confederate Constitution had been signed by the delegates to its convention, Jefferson Davis had been inaugurated as President of the CSA, and a provisional Confederate Congress had been seated an authorized an army.

As for the exceptions to the similarities between the US and Confederate Constitutions, Williams omits the affirmative protections expressly given slavery in the latter, particularly the permanent Constitution signed just after the Morrill Tariff was passed..

In working on this post I visited Williams’ faculty webpage at GMU. At the bottom of the page (here’s a screenshot), he includes a pearl he calls “Wisdom of the Month”:

That sounded like awfully modern vernacular for an author born in in the reign of George II, and sure enough, it is. It’s actually a quote from Edith Hamilton (1867-1963), and first appeared in her essay, “The Lessons of the Past” in a September 1958 edition of the Saturday Evening Post. I guess it doesn’t sound sufficiently conservative if it’s correctly attributed to a female academic with a same-sex life partner.

Andy, good rebuttal.

Sadly this is one of those lines which are continually reissued, almost seasonally, despite a mountain of evidence to the contrary. You may recall I wrote about this a few years back in a guest post on Robert’s blog (http://cenantua.wordpress.com/2011/03/21/it-was-all-about-taxes/ ). The argument is often made that while those tariffs were collected in NY, it was the southerners who paid them as the tag was passed from merchant to consumer.

Well that sounds all nice, but the details say otherwise. Of the tariffs collected, those on eight specific items accounted for over half the revenue generated in NY – silk, brown sugar, whole cotton cloth, rawhide and skins, flax cloth, tobacco, and raw iron. To say the southern consumer paid a disproportionate amount, one must make the case that wool, silk, brown sugar, cotton and flax cloth, etc. were disproportionately purchased by the southern markets. So northern women didn’t like silk? And northern kids didn’t have hankering for cookies? Would southerners prefer no protection on the import of cheap tobacco? And wool (which at $29 million in tariffs a year could fund a nice portion of the defense budget of the time) is more marketable in the warm, humid south?

At a wider level, one can make the argument that the tariffs actually aided the growth of southern industry. Indeed had the south not seceded in 1861 and the Morril Tariff had passed, southern industrialists such as J.R. Anderson would have found their interests thriving under that protection. Southerners knew this. The southern textile industry, already growing, might have boomed over ten years. Indeed, Anderson was among those lobbying hard prior to 1860 for higher tariffs on iron (finished goods and raw pig iron). Even after secession, many southerners pressed for Confederate tariffs as a means to promote the growth of industry.

You see how that shoe fits all around?

Thanks, Craig. I’m sorry I overlooked that one, and have appended a note to my post to that effect.

It’s a long-standing and patently false argument that Williams makes, but it’s still staggering to see him (or DiLorenzo, ostensibly another authority on economics) make it.

The merchants who imported the goods – how many represented Southern interests?

What portion of the goods imported to NYC were transshipped to other parts of the country? How much to the South?

“How much to the South?”

I don’t know. Show us some detailed numbers on that, and we’ll see.

But it’s also a different question. Note what Williams said — “Southern ports paid 75 percent of tariffs in 1859.” That’s an outright falsehood, and a patently egregious one at that, coming from someone with his credentials.

Would you have us believe, Mr.Ruffian, that the south,1/3 or so of the country, bought the majority of imported goods??

Not just a majority, but apparently an overwhelming majority.

Again, I’d be happy to see some detailed numbers from a contemporary source that support that claim.

Jefferson Moon-

“Would you have us believe, Mr.Ruffian, that the south,1/3 or so of the country, bought the majority of imported goods??”

Andy Hall-

“Not just a majority, but apparently an overwhelming majority.

Again, I’d be happy to see some detailed numbers from a contemporary source that support that claim.”

I haven’t said.

*

What were the amount of imports to New York City AFTER secession? January-February-March-April-May-June 1861? Compare to the same period in 1860.

An increase? Decrease? Or about the same?

What were the imports to Charleston, Savannah, Mobile, New Orleans, Galveston AFTER secession? Increase? Decrease? About the same?

You’re good at asking others to do research to verify claims you make, BR.

How’s that list of a regiment’s worth of enlisted African Americans in the Stonewall Brigade coming? We’re looking forward to seeing that.

BR-

“What were the amount of imports to New York City AFTER secession? January-February-March-April-May-June 1861? Compare to the same period in 1860.”

Imports of Dry Goods at New York

……………………..1860………………..1861

January…….$11,770,005………$10,956,857

February…….13,880,683………….6,782,936

March…………9,022,403…………..5,836,176

April……………4,865,743…………..2,767,645

May……………5,581,598…………..2,489,828

June…………..5,535,042…………..1,205,382

http://books.google.com/books?id=mAMdAAAAIAAJ&pg=PA143&lpg=PA143&dq=%22imports+of+dry+goods%22+1861&source=bl&ots=USW0mCXaWD&sig=FAVzVgR5IUsRnM0SfThT3jQWAt4&hl=en&sa=X&ei=jG0vUf_NPIfo8QSe44CQCA&sqi=2&ved=0CC0Q6AEwAA#v=onepage&q=%22imports%20of%20dry%20goods%22%201861&f=false

And, of course, imports dropped to near zero in those Southern ports after secession. Looks like Wigfall & Co. screwed it up for everybody.

BR,

Nice try.

Dry goods imports constitute only part of total imports, and not the biggest part.

Just look the same page you are quoted, next topic “Total imports and exports at New York”, and you see that dry goods imports are between one quartet and one third of total imports. And that total imports increase while dry goods import drops is not just possibility, but reality.

Try again:)

Alex Barhavin

Update section-

“…those same tariff laws, which supposedly were so beneficial to Northern industries, also protected Southerners’ production of things like cotton, tobacco and sugar from competition from overseas.”

If the tariff were on raw materials it would help the South. If on finished products (cotton goods, refined sugar) it would help the North.

Raw sugar was tariffed at 24%. Raw tobacco was tariffed at 24%, and manufactured tobacco products at 30%. Rice was tariffed at 15%. Timber was tariffed at 15%. Raw tallow was tariffed at 8%. Raw hides were tariffed at 4%, and tanned hides at 15%. Salt was tariffed at 15%. Beef and pork was both tariffed at 15%.

Raw cotton had been tariffed at 3 cents per pound in the 1840s. It was not tariffed on the eve of the war, but — and this is significant — even if untaxed, it was being imported in miniscule amounts. The total imports of baled cotton, nationwide, in 1859-60 amounted to the value of $140,387. At 10 to 13 cents per pound market price, that’s something like 2,160 to 2,800 bales, a cargo could be carried by a single, large sailing vessel. By contrast, in that same year, the U.S. exported $192 million of the staple — more than 1,000x as much as it imported. Even untariffed, cotton imports were so small as not to move the needle at all.

The Southern states were well-served by the tariffs in existence in the mid-19th century. Now, have you found detailed figures for the sales of imported goods in the South?

I think the “finished goods” argument is more hyperbole than fact. The numbers just don’t support it. It’s a stand made in thin air.

Even the planters were noticing the advantage of higher tariffs. As I outlined above, a high tariff on finished products such as cotton goods, refined sugar, tools, ironworks, etc. helped the south considerably. Those tariffs not only aided the growth of fledgeling businesses in the south, but also drew northern investments. There were many different interests in the south who sought to industrialize the region. And we have plenty of source material to show those interests supported, and supported strongly, higher tariffs on particular goods. The only “hurt” that tariffs really imposed upon the south was that of foreign investments (investments which served to hinder an agricultural economy in some ways, so arguably this was another point in favor of a tariff).

And here’s where the wheels really fall off of the tariff argument, IMO… In 1860 the Army and Navy were authorized $27.9M (authorized, then as now the actual expenditures varied). That figure is larger than any other four federal departments combined. Where were those military dollars going? Personnel, facilities upkeep, and new construction. Where was the Army money most focused? On seacoast defense, and decidedly in the south (outside of New York and Boston, many of the northern ports were arguably neglected). Even a simple examination of the ongoing projects shows a flow of money to southern states.

Rifles, cannons and other ordnance was delivered to southern stations in deference to other needs. Heck, Floyd all but admitted to improperly shifting contracts and weapons deliveries in the years prior to the Civil War (sort of the reason he left Fort Donelson in haste, if you recall).

So even if you do make a convincing argument that the south was paying a disproportionate amount (and I won’t concede that point until good evidence is presented), then the rebuttal is that the federal government was sending it right back south in the form of nice new forts, heavy iron cannons, and lots of shiny new rifled-muskets. As Andy often says, “Your mileage may vary.” 😉

“in case anyone was wondering, manures and guano were duty-free.”

Does that mean Dr. William’s article is duty-free?

Nice post Andy!

You remember Colonel “Bat” Guano, right?

Thanks for the mention—I have an article on the “tariff as a cause of secession” that will appear in North & South, someday.

between Williams and DiLorenzo, my impression is that economists should not dabble in history…

Understandable. I’ve read some good and useful analyses done by economists, but I think the rule ought to be that they should follow the same requirements for peer review that other academics do (in this case, by other economists). DiLorenzo’s academic publishing is sparse to begin with, and none of his CW writing has gone through that process.

A bit late but… I have seen similar stats but they combine import and export taxes and tariffs.

Thank you for a great post. I have noticed that Thomas DiLorenzo is not long on facts, but has a cult-like anti-Lincoln agenda. I have found various instances myself when he presents inaccurate or half-true “facts” and information to forward his agenda.

One question I have had, and for which I have not yet found any research, is how tax revenue was distributed and used in the Antebellum Era. I question to what extent it is factually correct that tax revenues were unfairly spent on the Northern and Western States and not to the benefit of the Southern States. Did the South maintain all their own lighthouses, harbors, and forts out of their own revenues and Georgia seems to imply its declaration of “causes which have led to the separation”.

In his July 4th 1861 Speech to Congress, Abraham Lincoln made the claim that “The nation paid very large sums (in the aggregate, I believe, nearly a hundred millions) to relieve Florida of the aboriginal tribes.” I am uncertain if this is referring to the Indian Removal Act of 1830, or is specific only to the state of Florida. But I have been unable to verify that figure. However I have discovered many figures which were spent that most definitely benefited the Southern (or future) Southern states.

Here are some expenditures of note:

Louisiana Purchase in 1802 $15 million.

Florida purchase in 1819 $5 million.

Mexican Cession and Texas Debts in 1848 $15 million.

Gadsen Purchase in 1853 $10 million.